Your motoring history is one of the factors insurance provider utilize to assist establish your rates, which means an accident or a traffic ticket can have a considerable influence on just how much you pay for insurance (laws). Maintaining your driving document tidy is the simplest and most reliable means to keep your insurance sets you back reduced.

Insurer in some states price vehicle drivers based upon their credit report. credit. In theory, this is since chauffeurs with reduced credit report are much more likely to submit an insurance claim instead of paying for problems out-of-pocket, however in technique it often ends up unfairly penalizing some drivers. Due to this, The golden state legislations avoid insurance provider from rating based upon credit report.

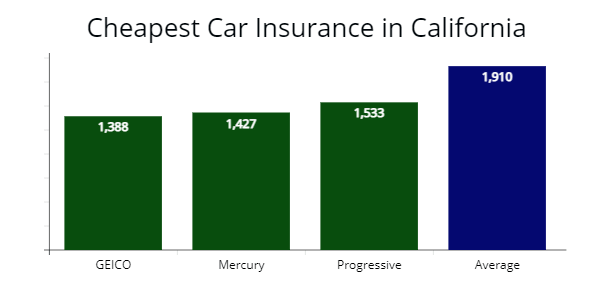

Frequently asked concerns, Just how much is car insurance policy each month in The golden state? Drivers in California pay approximately $1,857 per year for vehicle insurance policy, which breaks down to $154. 75 monthly - perks. Why are vehicle insurance policy rates in California so high? There are lots of reasons auto insurance coverage is so expensive in California (affordable auto insurance).

/midsection-of-man-signing-car-insurance-form-928675064-5b6cd420c9e77c00256cc9da.jpg) affordable car insurance cheaper car risks affordable car insurance

affordable car insurance cheaper car risks affordable car insurance

Is California a fault or no mistake state? The golden state is an at-fault state, which suggests a vehicle driver who is at fault in a mishap is in charge of the bodily injury and building damages expenses triggered by the accident, whether they have adequate auto insurance coverage to cover those expenses. cheap car.

automobile cheaper cheapest car vehicle insurance

automobile cheaper cheapest car vehicle insurance

Prices for driving violations and "Poor" credit score determined making use of ordinary rates for a solitary man 30-year-old driver with a credit rating score under 578. Your real quotes might differ.

The Only Guide for California Car Insurance Coverage

As well as having an automobile indicates having cheap vehicle insurance coverage. While cars and truck insurance policy is easy sufficient to locate, economical isn't so simple to discover.

We are mosting likely to stroll you via everything you need to understand to obtain trustworthy protection at the very best feasible rate! How Does Cars And Truck Insurance Coverage Job? One of the reasons that inexpensive automobile insurance coverage in California is hard to locate is that many vehicle drivers do not recognize that much regarding car insurance policy. laws.

On the a lot of fundamental degree, auto insurance assists secure you as well as other motorists on the roadway. Insurance coverage assists to pay for the damage that we cause to others or that others trigger to us as an outcome of a vehicle accident or various other certifying event (cars). Various sort of insurance policy shield you and your automobile in various type of means.

However, accident insurance coverage spends for damages to your auto no matter of who was at fault. Thorough insurance coverage helps cover points that might take place to your vehicle when you're not driving (such as burglary and also criminal damage). The more levels of car insurance coverage you have, the more security you and your automobile have against injuries as well as damages.

cheap cheap insurance insurance cheaper car

cheap cheap insurance insurance cheaper car

If you wish to get affordable auto insurance policy, you require to find the equilibrium in between just how much coverage you require and exactly how much cash you are ready to pay each month. vans. That's where Cost-U-Less Insurance can aid. Is Auto Insurance Affordable for Californians? As we said before, the majority of California drivers are persuaded they are paying way too much for cars and truck insurance policy (suvs).

Aflac - America's Most Recognized Supplemental Insurance ... - Truths

The typical price of complete coverage cars and truck insurance policy in The golden state is $172/month. The national typical cost of complete protection auto insurance policy is $139/month, while the ordinary minimum car insurance policy coverage is $47/month.

vans cheap cars insurance affordable

vans cheap cars insurance affordable

Auto insurance coverage costs depend on numerous elements, some within your control and some exterior of your control. Representatives at Cost-U-Less Insurance are fluent in locating means to assist you take advantage of your insurance policy bucks. What is the Average Vehicle Insurance Price in California? On standard, drivers in California pay $172/month for full protection auto insurance policy (cheap auto insurance).

Their average, in truth, is $174. But San Franciso vehicle drivers pay a standard of $233. Drivers in San Diego are appropriate around the state standard with $170. However motorists in Los Angeles are truly clearing those budgets: their typical price of car insurance coverage is a massive $274! Long tale short? The area you stay in is among the significant aspects that automobile insurance service providers use to determine just how much you pay on your month-to-month costs.

affordable auto insurance credit score insured car insurance companies

affordable auto insurance credit score insured car insurance companies

Compare Cars And Truck Insurance Policy Fees Currently you know that different factors aid figure out just how much you spend for vehicle insurance (insurance). Among the most reputable ways to decrease your vehicle insurance coverage premium is to compare different insurance coverage providers, which is something we concentrate on at Cost-U-Less Insurance policy. If you pay for your insurance policy one month at once, you can typically switch insurance providers whenever you intend to - auto insurance.

If you don't have vehicle insurance, your vehicle driver's permit might obtain suspended and also your vehicle impounded. After suspension, you should submit and also preserve evidence of vehicle insurance with the California Division of Motor Vehicles for 3 years. Insurance policy companies will certainly send you a card to reveal evidence of vehicle insurance coverage, so be certain to maintain it in your car to avoid these consequences (cheaper car).

Car Insurance In California Fundamentals Explained

Mercury takes pleasure in a distinct placement in the market offering its consumers with several of the state's most budget friendly as well as individualized agent-driven solution. Mercury offers greater than 1,000 independent agents in The golden state. Call one for a complimentary rate quote and begin conserving today. California Auto Insurance Discounts & Conveniences Mercury currently uses some of the lowest insurance rates available.

Ever since, it's not only end up Extra resources being the largest economic climate in America yet likewise the fifth-largest economic climate worldwide, defeating out the United Kingdom. credit. It's no surprise considering that The golden state deals so much, from the sparkling seas in San Diego completely as much as the stunning hills of Sierra Nevada.